In This Issue… Federal Reserve publishes paper on partnerships between community banks, fintechs Oklahoma City banker pends ope-ed in Oklahoman on IRS reporting proposal OBA welcomes new strategic member OBA education corner … Federal Reserve publishes paper on partnerships between community banks, fintechs To support responsible innovation in the community banking sector, the Federal Reserve Board earlier this month published …

September 2021

-

September 20, 2021

Oklahoma City banker pens op-ed in Oklahoman on IRS reporting proposal

NBC Oklahoma President and CEO H.K. Hatcher appeared as a guest columnist in The Oklahoman this weekend, opining on the proposed IRS tax reporting law. Hatcher wrote the proposal would “result in unnecessary costs to taxpayers and add an extensive amount of extra and unnecessary work for everyone involved – the IRS and our financial institutions.” You can read Hatcher’s …

-

September 19, 2021

Executive News: Thank you, you shouldn’t have … really

I want to thank all of you for all you did for the American people during the PPP – a program of that magnitude had never been done before. You dealt with constant rule changes, lack of information and everything else that made your life hectic for months. Because of you, a massive number of businesses both small and large …

-

September 18, 2021

Agencies issue guide for community banks to evaluate fintechs

The federal bank regulatory agencies last last month released a guide intended to help community banks assess risks when considering relationships with financial technology (fintech) companies. This guide, “Conducting Due Diligence On Financial Technology Companies,” is intended to be a resource for community banks when performing due diligence on prospective relationships with fintech companies. It is available on the Federal …

-

September 17, 2021

September 2021 OBA Legal Briefs

2021 OK legislation – Part II Oklahoma Power of Attorney Act – Part 1 By Pauli D. Loeffler Note: I am grateful to my extern Kelsey Hull for her assistance with this article. Kelsey is in her final year of law school at Oklahoma City University College of Law. You can look forward to an OBA Legal Briefs article authored …

-

September 17, 2021

Banking profits increase in second quarter

Despite the drop in net interest revenue, 64.1% of Oklahoma banks reported more net interest income than the previous year, according to the recently released Quarterly Banking Profile by the FDIC for the second quarter. For Oklahoma banks, the average return on assets was 1.24% in the second quarter of 2020, up from 0.36% the previous quarter. The FDIC reported …

-

September 16, 2021

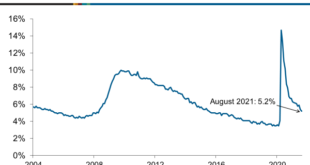

235,000 Jobs Added in August, Unemployment Rate at 5.2%

According to the Bureau of Labor Statistics, total nonfarm payroll employment increased by 235,000 in August. In August, the total number of unemployed people fell to 8.4 million, and the unemployment rate fell to 5.2%. Professional and business services, transportation and warehousing, private education and manufacturing accounted for the majority of employment growth in August. To read this story in its …

-

September 14, 2021

Week of Sept. 13

In This Issue… Senate members introduce bill to block IRS bank reporting requirements 2022 OBA Speaker Proposal forms due Oct. 20 OBA Emerging Leaders Academy application deadline is this week OBA Bankers’ Night Out programs begin this week in Ardmore Wednesday is last day to order Oklahoma Views and Vistas Calendar Registration open for ABA Virtual Washington Fly-In OBA education …

-

September 14, 2021

OBA highlights three points of action on IRS reporting proposal

As early as next week, Congress is expected to begin considering a new tax reporting requirement that would require banks to report information on account flows to the Internal Revenue Service. The proposal would require financial institutions to track and submit to the IRS information on every account that has a minimum balance of $600. This proposal raises serious data …

-

September 7, 2021

Week of Sept. 6

In This Issue… Loan-to-deposit ratios reach new lows during pandemic OBA Bankers’ Night Out programs begins next week in Ardmore OBA welcomes new endorsed vendor OBA education corner … Loan-to-deposit ratios reach new lows during pandemic As a result of the COVID-19 pandemic, numerous economic stimulus initiatives were implemented, including direct payouts to consumers and small company loan schemes. The …

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!