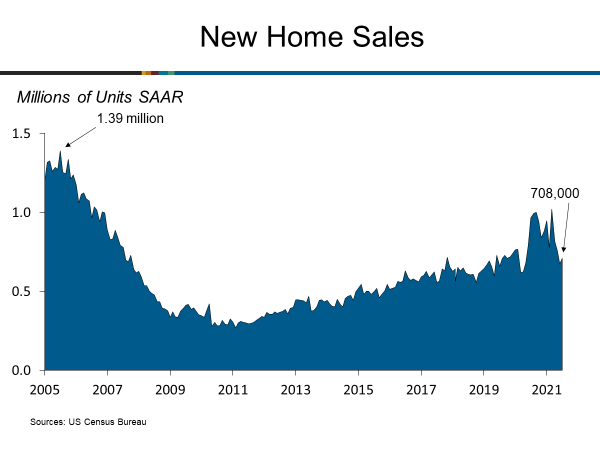

According to the U.S. Census Bureau and the Department of Housing and Urban Development, new single-family home sales increased to a seasonally adjusted annual rate of 708,000 in July. The June rate is 1.0% higher than the revised June rate of 701,000, but it is still 27.2% lower than the July 2020 forecast of 972,000. To read more about this story, click …

Read More »Jeremy Cowen

Week of Oct. 4

In This Issue… OCC reports improvement in mortgage performances OBA president/CEO interviews on pair of Tulsa TV stations about IRS reporting proposal Bankers’ Night Out fall series continues this month OBA education corner … OCC reports improvement in mortgage performances The Office of the Comptroller of the Currency reported last week the performance of first-lien mortgages in the federal banking …

Read More »OBA president/CEO interviews on pair of Tulsa TV stations about IRS reporting proposal

OBA President and CEO Adrian Beverage appeared on two Tulsa TV stations this week to discuss the IRS reporting proposal and its possible negative ramifications. You can watch both video, as well as read the accompanying news stories by clicking the links below: FOX 23 – Sept. 29 KTUL – Sept. 30

Read More »Nondeductible portion of OBA dues calculated

The calculation representing the nondeductible portion of member dues attributable to lobbying expenditures has been made for the OBA’s year ending April 30, 2021. The source of the information used to determine this percentage included the Association’s general ledger and an estimate of the percentage of time related to applicable personnel’s involvement with lobbying activities by management of the Association. …

Read More »Week of Sept. 27

In This Issue… SBA issues final rule regarding Paycheck Protection Program Two Fed presidents announce early retirement under similar circumstances Nondeductible portion of OBA dues calculated 2021 Hall of Fame Luncheon & Induction Ceremony set for Dec. 2 OBA education corner … SBA issues final rule regarding Paycheck Protection Program The Small Business Administration has issued a final rule outlining …

Read More »Week of Sept. 20

In This Issue… Federal Reserve publishes paper on partnerships between community banks, fintechs Oklahoma City banker pends ope-ed in Oklahoman on IRS reporting proposal OBA welcomes new strategic member OBA education corner … Federal Reserve publishes paper on partnerships between community banks, fintechs To support responsible innovation in the community banking sector, the Federal Reserve Board earlier this month published …

Read More »Oklahoma City banker pens op-ed in Oklahoman on IRS reporting proposal

NBC Oklahoma President and CEO H.K. Hatcher appeared as a guest columnist in The Oklahoman this weekend, opining on the proposed IRS tax reporting law. Hatcher wrote the proposal would “result in unnecessary costs to taxpayers and add an extensive amount of extra and unnecessary work for everyone involved – the IRS and our financial institutions.” You can read Hatcher’s …

Read More »Executive News: Thank you, you shouldn’t have … really

I want to thank all of you for all you did for the American people during the PPP – a program of that magnitude had never been done before. You dealt with constant rule changes, lack of information and everything else that made your life hectic for months. Because of you, a massive number of businesses both small and large …

Read More »Agencies issue guide for community banks to evaluate fintechs

The federal bank regulatory agencies last last month released a guide intended to help community banks assess risks when considering relationships with financial technology (fintech) companies. This guide, “Conducting Due Diligence On Financial Technology Companies,” is intended to be a resource for community banks when performing due diligence on prospective relationships with fintech companies. It is available on the Federal …

Read More »Banking profits increase in second quarter

Despite the drop in net interest revenue, 64.1% of Oklahoma banks reported more net interest income than the previous year, according to the recently released Quarterly Banking Profile by the FDIC for the second quarter. For Oklahoma banks, the average return on assets was 1.24% in the second quarter of 2020, up from 0.36% the previous quarter. The FDIC reported …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!