In This Issue… Democrats likely to scale back Treasury’s IRS bank reporting plan OCC releases updated LIBOR transition self-assessment tool Bankers’ Night Out fall series continues with upcoming dates in OKC, Woodward, Lawton OBA education corner … Democrats likely to scale back Treasury’s IRS reporting plan Senate Democrats will likely reveal a scaled-back version of a Biden administration proposal to …

Read More »Jeremy Cowen

Banking profits increase in 2021’s second quarter

Despite the drop in net interest revenue, 64.1% of Oklahoma banks reported more net interest income than the previous year, according to the recently released Quarterly Banking Profile by the FDIC for the second quarter. For Oklahoma banks, the average return on assets was 1.24% in the second quarter of 2020, up from 0.36% the previous quarter. The FDIC reported …

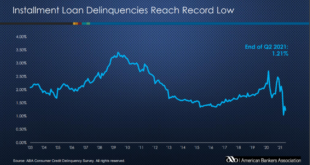

Read More »Consumer delinquencies hit new low in second quarter

According to the American Bankers Association’s latest Consumer Credit Delinquency Bulletin, consumer credit delinquencies hit a new low in the second quarter of 2021 as the economy continued to improve. When compared to the previous quarter, delinquencies decreased in nine of the 11 loan categories analyzed by ABA. In the second quarter, delinquencies on bank cards (credit cards issued by …

Read More »Budget reconciliation package likely to include IRS reporting provision

The American Bankers Association reported that House Speaker Nancy Pelosi (D-Calif.) told reporters Tuesday that Democrats plan to include a controversial tax reporting provision in their budget reconciliation package to require banks to report information to the IRS on gross inflows and outflows on customer accounts above a certain de minimis threshold. Pelosi did not specify what the threshold would …

Read More »Week of Oct. 12

In This Issue… Fed report finds bank branch distance stable for customers Longtime OBA employee’s spouse passes away Interested in speaking at OBA events? 2021 Oklahoma Bankers Hall of Fame ceremony set for Dec. 2 OBA education corner … Fed report finds bank branch distance stable for customers Despite an increase in bank consolidation over the past 20 years, the …

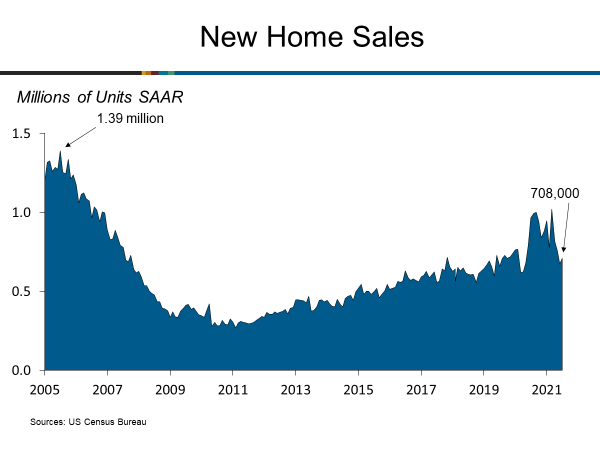

Read More »New Home Sales Rise in July

According to the U.S. Census Bureau and the Department of Housing and Urban Development, new single-family home sales increased to a seasonally adjusted annual rate of 708,000 in July. The June rate is 1.0% higher than the revised June rate of 701,000, but it is still 27.2% lower than the July 2020 forecast of 972,000. To read more about this story, click …

Read More »New Home Sales Rise in July

According to the U.S. Census Bureau and the Department of Housing and Urban Development, new single-family home sales increased to a seasonally adjusted annual rate of 708,000 in July. The June rate is 1.0% higher than the revised June rate of 701,000, but it is still 27.2% lower than the July 2020 forecast of 972,000. To read more about this story, click …

Read More »Week of Oct. 4

In This Issue… OCC reports improvement in mortgage performances OBA president/CEO interviews on pair of Tulsa TV stations about IRS reporting proposal Bankers’ Night Out fall series continues this month OBA education corner … OCC reports improvement in mortgage performances The Office of the Comptroller of the Currency reported last week the performance of first-lien mortgages in the federal banking …

Read More »OBA president/CEO interviews on pair of Tulsa TV stations about IRS reporting proposal

OBA President and CEO Adrian Beverage appeared on two Tulsa TV stations this week to discuss the IRS reporting proposal and its possible negative ramifications. You can watch both video, as well as read the accompanying news stories by clicking the links below: FOX 23 – Sept. 29 KTUL – Sept. 30

Read More »Nondeductible portion of OBA dues calculated

The calculation representing the nondeductible portion of member dues attributable to lobbying expenditures has been made for the OBA’s year ending April 30, 2021. The source of the information used to determine this percentage included the Association’s general ledger and an estimate of the percentage of time related to applicable personnel’s involvement with lobbying activities by management of the Association. …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!