The federal bank regulatory agencies announced on Dec. 31 the annual adjustment to the asset-size thresholds used to define small bank, small savings association, intermediate small bank, and intermediate small savings association under the Community Reinvestment Act regulations. The annual adjustments are required by the CRA rules. Financial institutions are evaluated under different CRA examination procedures based upon their asset-size …

Read More »Homepage News

Merry Christmas from the Oklahoma Bankers Association!

The OBA will be closed on Tuesday, Dec. 24, and Wednesday, Dec. 25, for Christmas. We will reopen at our regular time on Thursday, Dec. 26. We will also be closed on Wednesday, Jan. 1, for New Year’s Day. We will reopen at our regular time on Thursday, Jan. 2. Merry Christmas and happy New Year’s to you and your …

Read More »Federal banking agencies release 2018 CRA data on lending

The 700 banks that reported 2018 Community Reinvestment Act data concerning their work in small business, small farm and community development lending had the information released this week by the federal banking agencies. You can read all the info, data and statistics regarding the 2018 CRA lending data by clicking here.

Read More »Five bankers inducted into Oklahoma Bankers Hall of Fame as 2019 class

The Oklahoma Bankers Hall of Fame inducted its 2019 class – its second ever – today at the Oklahoma History Center in Oklahoma City. John V. Anderson, with F&M Bank; the late Clark and Wanda Bass, with First National Bank & Trust Co., in McAlester; Oklahoma State Banking Commissioner Mick Thompson; and the late Morrison Tucker, a longtime prominent Oklahoma …

Read More »Poll: Young Americans still enjoy going to bank

According to a new poll shared by CNN Business, more than 70 percent of millennial and post-millennial customers still regularly visit a brick-and-mortar location bank, instead of relying solely on digital banking methods. Seventy-two percent of GenZ consumers visit a physical bank branch at least monthly, the highest of any age group, according to a study of 1,000 consumers by …

Read More »OBA’s Beverage in The Oklahoman: Oklahoma banking remains “strong”

OBA President and CEO Roger Beverage was quoted prominently in a story in the Sunday, Nov. 10 edition of The Oklahoman, discussing Oklahoma banking. The story focused on how banks in the state have adapted – and generally remained strong – with the increased regulations stemming from the 2010 Dodd-Frank Act. You can read the entire story on The Oklahoman’s …

Read More »OBA hosting meet-and-greet with Rep. Mullin

The OBA is hosting a meet-and-greet with Rep. Markwayne Mullin from 11:30 a.m.-12:15 p.m. on Nov. 8 at the OBA offices in Oklahoma City. All bankers and any guests they would like to bring are invited. No RSVP is necessary, but if you have any questions, please contact Adrian Beverage (adrian@oba.com) at the OBA.

Read More »Oklahoma Bankers Hall of Fame ceremony set for Dec. 5

The Oklahoma Bankers Hall of Fame will induct its second-ever class on Dec. 5 at the Oklahoma History Center in Oklahoma City. John V. Anderson, with F&M Bank in Crescent; Mick Thompson, with the Oklahoma State Banking Department; Clark and Wanda Bass, with First National Bank & Trust Co., in McAlester; and Morrison Tucker, a longtime Oklahoma City banker, will …

Read More »House passes AML modernization bill in bipartisan vote

The House voted late Tuesday 249-173 to pass the Corporate Transparency Act (H.R. 2513). The legislation, sponsored by Rep. Carolyn Maloney (D-N.Y.), would direct the Financial Crimes Enforcement Network to create a national database that banks could use to verify a business’s beneficial ownership information. The bill was amended before passage to include legislation championed by Rep. Emanuel Cleaver (D-Mo.) …

Read More »Credit card delinquencies fall as other consumer delinquencies rise

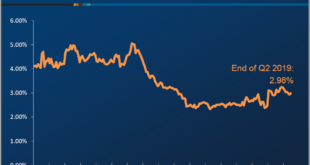

Consumer credit delinquencies were mixed in the second quarter, with delinquencies falling for bank cards (credit cards provided by banks) and rising for the composite index of closed-end loans, according to results from the ABA’s Consumer Credit Delinquency Bulletin. Overall, delinquencies rose in eight of the 11 categories tracked by ABA while three categories fell. The composite ratio, which tracks …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!