In This Issue… Supreme Court to hear CFPB constitutionality claim BSA/AML bills to be considered by House Final Bankers’ Night Outs set for this week OBA education corner …

Read More »Jeremy Cowen

Credit card delinquencies fall as other consumer delinquencies rise

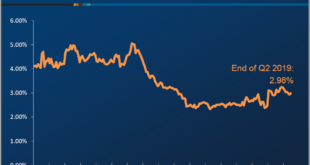

Consumer credit delinquencies were mixed in the second quarter, with delinquencies falling for bank cards (credit cards provided by banks) and rising for the composite index of closed-end loans, according to results from the ABA’s Consumer Credit Delinquency Bulletin. Overall, delinquencies rose in eight of the 11 categories tracked by ABA while three categories fell. The composite ratio, which tracks …

Read More »Week of Oct. 14

In This Issue… Credit card delinquencies fall as other consumer delinquencies rise Bankers’ Night Out events wrap up next week OBA education corner …

Read More »Reviewing CFPB’s latest supervisory highlights

The Consumer Financial Protection Bureau recently released its Summer 2019 Supervisory Highlights, which includes key findings from the CFPB’s exams for the most part between December 2018 to March 2019. In each edition, the Bureau chooses the areas where it has seen the most supervisory activity, and for this one, it highlighted auto loan origination, credit card account management, debt …

Read More »Oklahoma banks preach patience as Paycheck Protection Program launches

OKLAHOMA CITY — With the COVID-19 pandemic impacting communities and businesses across the state, Oklahoma banks are focused on helping as much as they can. The Paycheck Protection Program will offer some relief to small businesses in Oklahoma as it launches on Friday, April 3. Oklahoma bankers, however, do ask for patience from the public as the program begins. Financial …

Read More »Week of Oct. 7

In This Issue… Reviewing CFPB’s latest supervisory highlights Preparing comment letter about FedNow OBA education corner …

Read More »Agencies finalize rule raising residential real estate appraisal threshold

On Friday, Sept. 27, federal banking agencies issued a final rule that raises the appraisal threshold for residential real estate transactions to $400,000. The threshold has been at $250,000. The new threshold addresses numerous concerns raised industry stakeholders over the time and cost of appraisals. Under the rule, transactions that qualify for the exemption still need to obtain an evaluation …

Read More »Week of Sept. 30

In This Issue… Agencies finalize rule raising residential real estate appraisal threshold SAFE Banking Act will benefit customers Banker op-ed: Lack of interoperability in real-time payments could limit choice OBA education corner …

Read More »Oklahoma delegation splits on cannabis-related legislation

Last night, we distributed a Banker Direct in which we included the news about the U.S. House of Representatives’ passage of H.R. 1595, the SAFE Banking Act. The bill was placed on the suspension calendar (meaning it was non-controversial) and passed 321-103, with nine members not voting. We were able to access the vote tally late last night and the …

Read More »SAFE Banking Act passes House

The U.S. House of Representatives passed the SAFE Banking Act earlier today in a 321-103 bipartisan vote. The Act would help legal cannabis-related businesses gain access to banks without punishment from federal banking regulators. The bill would also help banks meet the needs of their communities while also reducing the possibility of cash-motivated crimes at marijuana-related businesses because of their …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!