The Federal Deposit Insurance Corporation (FDIC) disclosed the second quarter results of the banking industry this week.

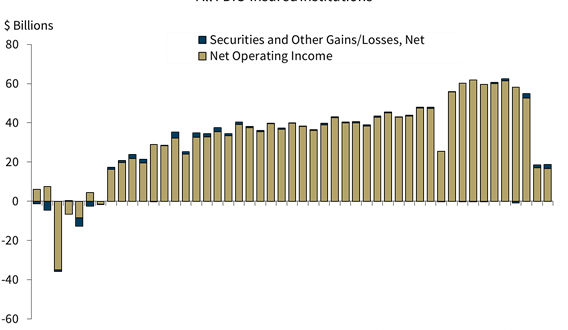

“Commercial banks and savings institutions saw a decrease in net income of 70 percent from a year ago, while liquidity and capital levels remained very strong to meet loan demand and absorb any losses in the future.”

“Industry income in total was down $43.7 billion, or 70% from a year ago,” OBA Chief of Staff/Director of Government Relations Adrian Beverage said. “In Oklahoma, net income was down by $31 billion or 3.9%. That having been said, Oklahoma banks have become better capitalized, growing equity capital by $877 million (6.1%) compared to last year at this same point in time.”

According to the FDIC’s announcement, the decline in net income parallels the continuing decline of the nation’s economy and the uncertainty that surrounds the COVID-19 virus. The graph above shows what the picture looks compare to previous years.

“Lower levels of business activity and consumer spending – combined with uncertainty about the path of the economy and the low interest-rate environment – contributed to higher provisions for loan and lease losses, as well as a decrease in net interest margins. Notwithstanding these disruptions, however, the banking industry maintained strong capital and liquidity levels at the end of the second quarter, which will protect against potential losses in the future,” FDIC Chairman Jelena McWilliams said.

Meanwhile, the total number of banks in Oklahoma has dropped by 4% compared to last year.

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!