In This Issue…

- Oklahoma banks remain strong in second quarter

- Inhofe and Lankford sign on as co-sponsors of S. 4117; Lucas, Horn and Cole co-sponsor House version of small PPP loan forgiveness

- Answer leadership’s call: OBA Emerging Leaders Academy accepting applications

- Oklahoma Views & Vistas calendar available for discounted pricing through Aug. 31

- OBA education corner …

Oklahoma banks remain strong in second quarter

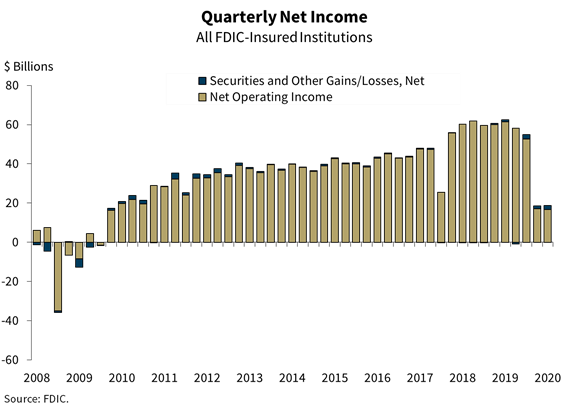

This morning the Federal Deposit Insurance Corporation (FDIC) disclosed the second quarter results of the banking industry.

“Commercial banks and savings institutions saw a decrease in net income of 70 percent from a year ago, while liquidity and capital levels remained very strong to meet loan demand and absorb any losses in the future.”

“Industry income in total was down $43.7 billion, or 70% from a year ago,” OBA Chief of Staff/Director of Government Relations Adrian Beverage said. “In Oklahoma, net income was down by $31 billion or 3.9%. That having been said, Oklahoma banks have become better capitalized, growing equity capital by $877 million (6.1%) compared to last year at this same point in time.”

According to the FDIC’s announcement, the decline in net income parallels the continuing decline of the nation’s economy and the uncertainty that surrounds the COVID-19 virus. Here’s what the picture looks compare to previous years:

“Lower levels of business activity and consumer spending – combined with uncertainty about the path of the economy and the low interest-rate environment – contributed to higher provisions for loan and lease losses, as well as a decrease in net interest margins. Notwithstanding these disruptions, however, the banking industry maintained strong capital and liquidity levels at the end of the second quarter, which will protect against potential losses in the future,” FDIC Chairman Jelena McWilliams said.

Meanwhile, the total number of banks in Oklahoma has dropped by 4% compared to last year.

Inhofe and Lankford sign on as co-sponsors of S. 4117; Lucas, Horn and Cole co-sponsor House version of small PPP loan forgiveness

Your work has paid off!

Both Oklahoma senators have agreed to co-sponsor S. 4117 – The Paycheck Protection Small Business Forgiveness Act. Bankers across the nation are stepping up their efforts as they engage with their respective two senators and are building more momentum for this bill’s passage. The number of co-sponsors is 30 so far.

The bill provides automatic forgiveness of all PPP loans of $150,000 or less. That’s approximately 85% of the total count of PPP loans, and about 26% of the money allocated for the Program.

Sen. Kevin Cramer (R-ND) is the bill’s lead sponsor.

“Providing a simplified loan forgiveness process for small business owners will help lessen the burden they have shouldered due to coronavirus,” Cramer said. “It’s the least Congress can do to help them get back on their feet and help get people safely back to work.”

In addition, three members of the Oklahoma delegation have signed on as co-sponsors of the bipartisan companion House legislation (H.R. 7777). All of these members and our state’s two senators are trying desperately to stand up for Oklahoma small business borrowers and PPP lenders!

Thank you for helping to make a difference by reaching out to our delegation and encouraging them to help with this monumental effort. Your voice has been heard as have the voices of Oklahoma’s small businesses.

Answer leadership’s call: OBA Emerging Leaders Academy accepting applications

Take note the OBA 2020-21 Emerging Leaders Academy is currently accepting applications.

We’re looking for the best and brightest bankers who seek to sharpen their leadership skills. The Academy will help you reach new heights with powerful speakers offering information leaders need for effectively maneuvering in today’s business climate. Each session helps participants become true leaders by understanding those around you through non-traditional methods.

The OBA extends an invitation to any employee of a bank that is a member of the OBA to apply. A panel of bankers will review the applicants and choose those accepted into the Academy (maximum 30 bankers). Participants must attend all sessions to successfully graduate from the program.

There are six sessions to the Academy: Nov. 4, Dec. 10, Jan. 22, Feb. 23, March 26, April 30. Graduation will take place in May 2021 at the OBA Annual Convention.

Click here for more information or to apply! For more information, please contact Megan McGuire at (405) 424-5252 or megan@oba.com.

Oklahoma Views & Vistas Calendar available for discounted pricing through Aug. 31

The 2021 Oklahoma Views & Vista Calendar is now ready to be purchased – order yours by Aug. 31 (newly extended deadline) to get the special low price of just 99 cents per calendar. Pricing after Aug. 31 is $1.09 per calendar. Final deadline to purchase is Sept. 15.

This is a great way to share your bank’s logo and information to your customers! Click here for more information and an order form.

OBA education corner …

Some live events are starting to peek their heads out from underneath the blanket! Look for those coming up soon. You can also download a flyer highlighting upcoming webinars by clicking here, or just peruse below for those coming soon!

NOTE: Effective March 16, and until further notice, TTS (our webinar provider) has extended the OnDemand access period for all ‘Live Plus Five (Days)’ registrants to 60 days (versus five business days). Also, they are waiving the $75 per location fee for additional locations

- Strategic Planning for Financial Institutions – It’s All About Your Strategy!, Sept. 1, webinar — This year brought unexpected change, uncertainty, and fear to the entire world due to the pandemic. Community financial institutions must quickly adapt and so does your strategic plan.

- Thirty Steps to Audit Your Safe Deposit Area, Sept. 2, webinar — Management should take full advantage of an effective safe deposit audit program as their protection against losses due to negligence or carelessness.

- Best-Ever Compliance Checklists for Commercial Loans, Sept. 3, webinar — This colorful checklist, patterned after the popular Best-Ever Consumer Checklists, will guide bankers through compliance traps and ensure compliance.

- Federal Benefit Payments Garnishment Requirements, Sept. 8, webinar — Compliance officers, legal counsel and financial institution personnel who process garnishment answers should consider tuning in to this webinar.

- 2020 Virtual FDIC Banker Outreach, Sept. 9, virtual seminar — All bank directors, CEOs and executive officers are encouraged to participate in this timely update. Compliance officers also will find the information useful.

- Loan Participations for Community Banks: Risks & Rewards, Sept. 9, webinar — This program covers the risks and rewards of loan participations to both the lead bank and the purchasing bank.

- Audit Report Writing, Sept. 9, webinar — This highly specialized webinar offers a deep and useful toolbox of techniques that auditors can use when noting audit observations, drafting objective work papers and composing well-structured, detailed and fluent audit reports.

- Quarterly Compliance Briefing: Fall 2020, Sept. 10, webinar — Anyone in your institution having compliance responsibilities – when you think about this, it could be just about anyone in the institution – should be interested in this webinar.

- Violence In Your Workplace: Prevention & Response, Sept. 10, webinar — This session will benefit you not only in your work life, but your personal life as well. Have you ever thought how you would react in a robbery? A violent confrontation? An active shooter situation?

- Seven Habits of Effective Credit Administration in Commercial Banks, Sept. 11, webinar — Specifically, this course is intended to provide guidance on how to develop and maintain a credit administration function that will provide guidance to anyone involved in the credit function of the bank and to insure safeguards are in place to manage the bank’s loan portfolio in a safe and sound manner.

- Flood Insurance: Compliance Issues and Hot Spots, Sept. 14, webinar — We’ll concentrate on some of the more vexing current issues in flood compliance, such as monitoring, contents coverage and the ever-present condo problem, by talking through sample scenarios and explaining best practices in keeping your portfolio covered.

- 2020 OBA Basic Banking School, Sept. 14-17, Oklahoma City — The school is designed to introduce students to basic banking concepts as they relate to the overall functioning of a bank.

- Understanding TIL Disclosures for Non-TRID Loans, Sept. 15, webinar — This two-hour program provides a comprehensive review of the disclosure rules for closed-end credit transaction that are not secured by real property.

- CRA Nuts & Bolts – Five Steps to Pass the Exam, Sept. 16, webinar — Writing a dynamic CRA context report can show examiners not only that your financial institution understands the community credit needs, but that you are effectively meeting the needs in the assessment areas you serve.

- Agricultural Loan Documentation & Administration, Sept. 16, webinar — Gain an essential understanding of agricultural collateral, risk management, loan documentation, loan administration and loan monitoring.

- Deposit Regulatory Update and Review, Sept. 16, webinar — During this one-day program we will cover many issues that are a hot spot for regulators.

- BSA Officer & Staff Annual Update and Review, Sept. 17, webinar — . During this all-day program, we will talk about current sanctions, regulator expectations for 2020.

- Business Continuity and Cybersecurity in a New World, Sept. 23, Oklahoma City — Presidents, CFOs, operations team members and others involved in contingency planning should consider attending this seminar.

- Analyzing Financial Statements, Sept. 30-Oct. 2, Oklahoma City — This three-day seminar is a must for those in commercial lending.

- 2020 OBA Consumer Lending School, Oct. 5-9, Oklahoma City — This program exposes students to major issues consumer credit managers face. It provides a framework for examining a bank’s consumer credit programs, policies and procedures.

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!