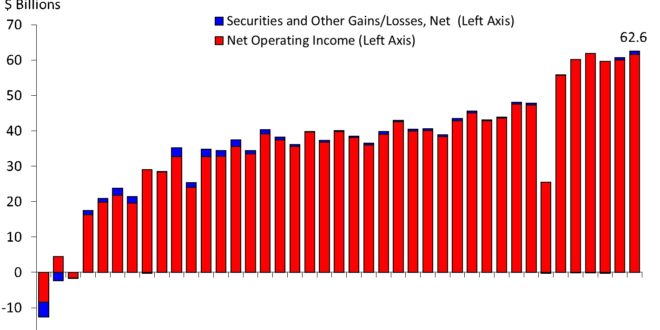

For the 5,303 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation, aggregate net income totaled $62.6 billion in second quarter 2019, an increase of $2.5 billion (4.1 percent) from a year earlier.

The improvement in net income is attributable to a $4.9 billion (3.7 percent) increase in net interest income. Financial results for second quarter 2019 are included in the FDIC’s latest Quarterly Banking Profile released on Sept. 5.

Oklahoma banks, however, saw a small decrease in net income from the same point in the previous year, down from $701 million at the end of the second quarter in 2018 to $674 million in the second quarter of this year.

It was a significant increase, however, over the $593 million reported at the end of the second quarter two years ago, in 2017.

“The banking industry reported another positive quarter,” FDIC Chairman Jelena McWilliams said. “Quarterly net income expanded due to higher net interest income, loan growth increased, asset quality indicators showed modest improvement, and the number of ‘problem banks’ continued to decline. Community banks also reported another positive quarter. Net income at community banks benefited from higher net operating revenue, and the annual rate of loan growth at community banks was stronger than the overall industry.

“With the recent lowering of short-term interest rates and inversion of the yield curve in the second quarter, new challenges for banks in lending and funding may emerge. Therefore, banks need to maintain rigorous underwriting standards and prudent risk management in order to support lending through the economic cycle.”

Highlights from the Second Quarter 2019 Quarterly Banking Profile

Net Income Increases 4.1 Percent from Second Quarter 2018: Aggregate net income for the 5,303 FDIC-insured institutions rose by $2.5 billion (4.1 percent) from a year earlier, led by higher net interest income. Almost 60 percent of all institutions reported a year-over-year increase in net income and less than 4 percent of institutions were unprofitable. The average return on assets remained stable at 1.38 percent.

Community Banks’ Net Income Increases 8.1 Percent from Second Quarter 2018: The 4,873 FDIC-insured community banks reported net income of $6.9 billion in second quarter 2019, up $522.7 million from a year earlier. Growth in net interest income (up 5.1 percent to $19.3 billion) and noninterest income (up 4.8 percent to $4.7 billion), as well as gains on securities sales (up 654.8 percent to $233 million) drove the annual increase in profitability. Combined growth in these areas offset increases in noninterest expense (up 5.6 percent to $15.3 billion) and provision expense (up 2.2 percent to $672.7 million).

Net Interest Income Increases 3.7 Percent from Second Quarter 2018: Net interest income rose by $4.9 billion (3.7 percent) from a year earlier to $139 billion in second quarter 2019. Slightly more than three out of four banks (75.1 percent) reported a year-over-year increase in net interest income. The average net interest margin remained stable from a year earlier at 3.39 percent.

Total Loan and Lease Balances Increase from the Previous Quarter and a Year Earlier: Total loan and lease balances rose by $152.2 billion (1.5 percent) from first quarter 2019. Growth among major loan categories was led by consumer loans, which includes credit cards, (up $42.2 billion, or 2.5 percent) and residential mortgage loans (up $38.3 billion, or 1.8 percent). Over the past 12 months, total loan and lease balances rose by 4.5 percent, a slight increase from the 4.1 percent annual growth rate reported last quarter. Commercial and industrial loans registered the largest dollar increase from a year earlier (up $142.7 billion, or 6.9 percent).

The Number of Banks on the “Problem Bank List” Declines to 56: The number of problem banks fell from 59 to 56 during the second quarter, the lowest number of problem banks since first quarter 2007. Total assets of problem banks increased from $46.7 billion in the first quarter to $48.5 billion.

The Deposit Insurance Fund’s Reserve Ratio Rises to 1.40 Percent: The Deposit Insurance Fund (DIF) balance increased by $2.6 billion from the previous quarter to $107.4 billion. The quarterly increase was mainly driven by assessment income, but unrealized gains on securities held by the DIF and a reduction in losses from past failures made considerable contributions. The reserve ratio increased by 4 basis points from the previous quarter to 1.40 percent.

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!