It’s officially October, and news on the presidential election is on every corner. The conversation has taken over social media, television and even the dinner table. While talking about the election is a great way to educate yourself and others, the most essential part is exercising your right to vote. The American Bankers Association has teamed with the Oklahoma Bankers …

Read More »Jeremy Cowen

SBA streamlines PPP loan forgiveness for $50,000 or less

The Small Business Administration tonight released a streamlined loan forgiveness application for Paycheck Protection Program loans of $50,000 or less. The forgiveness application, Form 3508S, includes certifications from the borrower but does not require calculations to be submitted with the application. Applicants must submit documentation verifying forgivable payroll and non-payroll expenses. Borrowers are required to retain the documentation supporting their …

Read More »Week of Sept. 28

In This Issue… Free-to-all ABA anti-phishing campaign kicks off Final call: Emerging Leaders Academy applications due on Oct. 1 Social Security Administration services available to all OBA education corner … Free-to-all ABA anti-phishing campaign kicks off The ABA has designed an anti-phishing campaign that is an excellent tool for all bankers. It is offered free to all bankers, ABA members …

Read More »Executive News: Next big hurdle: DEI, compliance concerns

We’ve all been impacted by the COVID-19 pandemic, some more than others. As many of you who read this column know, my wife and I have been self-quarantined since mid-March. Most days I work from home and I find the environment surprisingly calm and productive. On at least a weekly basis, I go to the office when no one else …

Read More »Navigating work absences due to closed schools

Crowe & Dunlevy As the school year begins, Oklahoma’s banks once again face the challenge of accommodating the need for employees to be home to care for school-age children due to the negative impacts of the COVID-19 pandemic. This article focuses on the relevant paid leave mandates of the Families First Coronavirus Response Act, the challenges caused by the varying …

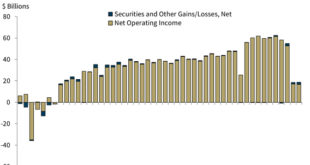

Read More »Pandemic strikes banks’ net income in second quarter

On August 25, the Federal Deposit Insurance Corporation reported the banking industry saw a 70 percent decline in net income when compared to net income in 2019. The Agency said liquidity and capital levels remain strong enough to meet loan demand and absorb any losses in the future. Although economic stress related to the COVID-19 pandemic continued to affect bank …

Read More »Week of Sept. 7

In This Issue… From the chairman … Join us for our “OBA Tuesday @10” Zoom session with guest Joy Hofmeister Register for OBA Virtual Washington Visit FDIC acting director of Office of Minority and Inclusion testifies before House subcommittee Absentee voter program in effect for general elections ABA gathering info on core processors Abrigo updates SBA forgiveness platform OBA education …

Read More »Register for OBA Virtual Washington Visit

Join fellow bankers and industry leaders from across the South Central United States for a virtual meeting with agency leadership and lawmakers. The OBA has partnered with the ABA and other state bankers associations for the South Central Regional Virtual Washington Visit, which is scheduled for Sept. 21-24. This year’s Washington Visit will ensure policies crucial to the banking industry …

Read More »Week of Aug. 31

In This Issue… Register for OBA Virtual Washington Visit 2020 OBA Oktoberfest Golf Tournament set for Oct. 5 Answer leadership’s call: OBA Emerging Leaders Academy accepting applications Check out OBA’s Strategic Members COVID-19 Resource Page OBA education corner …

Read More »Oklahoma banks remain strong in second quarter

The Federal Deposit Insurance Corporation (FDIC) disclosed the second quarter results of the banking industry this week. “Commercial banks and savings institutions saw a decrease in net income of 70 percent from a year ago, while liquidity and capital levels remained very strong to meet loan demand and absorb any losses in the future.” “Industry income in total was down …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!