We continue to hear from our bankers asking for more information on ATM jackpotting and MITM (Man-in-the-Middle) attacks in our state. A recent Texas Financial Crimes Intelligence Center Intelligence Brief (click here to download) contains updated details on the crime, as well as pictures from convenience store ATMs in Tulsa. A bit of good news is Oklahoma City Police Department recently …

Read More »Jeremy Cowen

Compliance Update seminars in Oklahoma City rescheduled

Due to the winter storm expected in our state, this week’s Compliance Update seminars in Oklahoma City have been rescheduled. The new date for the seminars is Thursday, Feb. 17, with the location still being the Harris Event Center at the OBA offices in Oklahoma City. If you have any questions about this change, don’t hesitate to contract the OBA’s …

Read More »Executive News: Happy new year as we prepare for busy 2022

Happy new year and welcome to 2022! I would encourage you to buckle up, as it looks like it’s going to be a busy year. I expect Washington to be as crazy as ever with possibly the most significant midterm election that we’ve seen in decades. Let’s not lose sight of everything that you as an industry accomplished in 2021. …

Read More »FDIC chairperson announces resignation

FDIC Chairperson Jelena McWilliams announced her resignation on Dec. 31 via a letter to President Joe Biden. McWilliams, a Republican, was named the 21st chairperson of the FDIC in June 2018 after being appointed by then-President Donald Trump. Her official departure has been set for Feb. 4, with FDIC board member Martin Gruenberg reported to become acting chairman – his …

Read More »Leverage ratio returns to 9% for new year

With the expiration of coronavirus-related relief provided under the CARES Act, the community bank leverage ratio will revert to a minimum of 9% starting on Jan. 1, 2022, the banking agencies said in late December. Banking organizations that elect the CBLR framework on their March 31, 2022, call reports will be subject to the requirement. “The community bank leverage ratio …

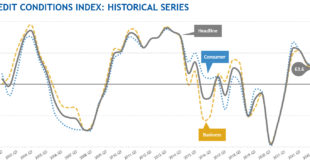

Read More »Credit market expectations for businesses, consumers confirm solid economic outlook

Bank economists expect credit conditions to continue improving for both consumers and businesses over the next six months, according to the American Bankers Association’s latest Credit Conditions Index released on Jan. 25. The latest summary of ABA’s Credit Conditions Index examines a suite of indices derived from the quarterly outlook for credit markets produced by ABA’s Economic Advisory Committee (EAC), which …

Read More »Week of Jan. 24

In This Issue… FDIC approves final rule on deposit insurance simplification OBA hosting meet-and-greet for treasurer candidate Federal Reserve Board releases results of senior bank officers survey on strategies for reserve balances OBA Intern Program ready for 2022 OBA education corner … FDIC approves final rule on deposit insurance simplification The Federal Deposit Insurance Corporation approved a final rule late …

Read More »Security agencies release alert on foreign cyber threats

The Cybersecurity and Infrastructure Security Agency, FBI and the National Security Agency have recently issued an alert titled “Understanding and Mitigating Russian State-Sponsored Cyber Threats to U.S. Critical Infrastructure“. It is a valuable addition to your bank’s cyber toolbox and includes mitigation tactics as well as a technical history of these state-sponsored actors. Detection and incident response are also covered …

Read More »OBA Intern Program ready for 2022

An OBA program to be aware of is the OBA Intern Program. The Intern Program will be active in 2022 and we’re looking for participating banks! For more information on this IMPORTANT program – important not only to aspiring students, but also to participating banks – Contact the OBA education department at (405) 424-5252 or click here for more information!

Read More »Week of Jan. 17

In This Issue… Bloomberg article: Cannabis banking is booming despite federal uncertainty Supreme Court blocks vaccine mandate Bankers at the State Capitol: Register for OBA’s 2022 Contact Banker Program OBA education corner … Bloomberg article: Cannabis banking is booming despite federal uncertainty The Bloomberg news service published a story in its daily newsletter today titled “Cannabis banking is booming despite …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!