In This Issue…

- From Adrian’s desk …

- Free treasury check verification service available for banks

- ABA, other association, laud bill to end abuse of mortgage trigger leads

- ELT system features several upgrades

- 2025 OBA Directory of Banks now available for purchase

- ‘The Bankers From Oklahoma’ are back! – OBA convention registration open!

- OBA education corner …

From Adrian’s desk …

By Adrian Beverage

OBA President & CEO

Just some random tidbits that might be of interest to our bankers this week!

• • •

Today is the last session of our Contact Banker Program for this spring. We have a large group today, which is great, but the attendance has been great all session for Contact Banker. I can’t thank everyone enough: It makes my job easier working with the legislators at the Capitol when they know I serve such a large and active industry!

• • •

Speaking of “lasts,” our last Bankers’ Night Out events are on Wednesday. Besides our annual trip to Pete’s Place in Krebs that evening, we have a special “lunch edition” set up at Shangri-La, in Afton.

• • •

I mentioned last week how the former Sooner, Jordy Bahl, has been killing it for my Huskers’ softball squad this season. Well, she outdid herself on Sunday! Bahl hit two home runs AND pitched a one-hit shutout with 11 strikeouts to beat a really good Washington team on the road.

I wonder if there’s a chance we could see Bahl take on her old teammates in the regional round of the upcoming NCAA tournament? That’d be fun!

Free treasury check verification service available for banks

For our members who found the Treasury Check Verification System portal difficult to enroll in or use, SentiLink is now offering access to their treasury check verification services free for anyone.

Yes, this is correct 100% with no strings attached. It is for any financial institution and will provide access to their SentiLink dashboard where you can verify Treasury check information, including the payee name for all checks issued by the U.S. Treasury.

Here is the link to learn more and see a demo of the dashboard verification.

ABA, other associations, laud bill to end abuse of mortgage trigger leads

The American Bankers Association and 16 groups are urging lawmakers to pass legislation banning the practice of credit reporting firms selling consumer contact information to lenders who then barrage those same consumers with unwanted solicitations.

The bipartisan Homebuyers Privacy Protection Act (S. 1467 and H.R. 2808) would amend the Fair Credit Reporting Act to eliminate abusive mortgage “trigger leads” and limit pre-screened credit offers to consumers who consent or who have a preexisting relationship with a financial institution.

In a letter to the leaders of the Senate Banking Committee and House Financial Services Committee, the groups – which represent a mix of industry and consumer groups – said the bill would protect consumers from the practice.

ELT system features several upgrades

Service Oklahoma recently launched several upgrades to the Electronic Liens and Titles system to continue modernizing vehicle services across the state.

Lienholders and dealers now have access to expanded vehicle information in OkCARS, making it easier to process transactions outside of normal business hours. Dealers can also electronically add liens for any lienholder through their OkCARS accounts – streamlining the process and reducing paperwork.

In addition, a notarized bill of sale, available on the Service Oklahoma website, is now required when transferring ownership of vehicles with electronic titles. As a reminder, the full transition to electronic titles takes effect on July 1. Paper titles issued before that date remain valid until the next vehicle transaction, when they will be converted to electronic.

Resources to Help You Navigate These Changes

To help you make the most of the new features, we’ve prepared several tools:

- FAQs – Answers to common questions.

- Training Guide – Step-by-step instructions for lien placement.

- Demo Video – A walkthrough of the latest features.

- Support – Contact eltaccounts@service.ok.gov for assistance or to be added to the ELT distribution list.

Live ELT Q&A – 3 p.m. on May 21

Save the date! Service Oklahoma staff will host a live Q&A session at 3 p.m. on Tuesday, May 21, for lienholders with questions about the new enhancements.

2025 OBA Directory of Banks now available for purchase

The latest edition of the OBA Directory of Banks is now available.

This essential reference includes financial data, important information about all Oklahoma banks, savings and loans, savings banks and holding companies, key personnel by function and title, answers to rules and regulations, legislators, state and national agencies, courthouses, fast-find index and much more!

Each Directory is $40 per copy for OBA-member bankers, and $60 for non-members.

Price breaks are available for larger bulk buys of more than nine copies: contact Thi Pham (thi@oba.com; 405-424-5252) for more information.

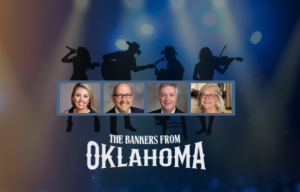

‘The Bankers From Oklahoma’ are back! – OBA convention registration open!

Join us in Oklahoma City this May for the can’t-miss event of the year – packed with valuable sessions, networking and a chance to reconnect with Oklahoma’s banking community. Whether you’re looking to expand your knowledge or simply enjoy a great time with fellow professionals, this event has something for every banker.

The connections are real, the conversations are waiting and your name tag is practically begging for a lanyard. We may not have fiddles or guitar solos, but we do have the ultimate gathering this side of Stillwater. Register now to secure your spot, both at convention AND the golf tournament!

May 12-14, 2025

The Skirvin Hilton

1 Park Avenue

Oklahoma City, OK 73102

*Due to pricing structure online registration is not available.

OBA education corner …

Rain, rain, go away

Come back another day

We’ve found ourselves singing the old schoolyard staple above several times the past week. Between the morass that describes most of our yards right now, and just the general irritation of not seeing the sun for several days, we can officially say we’re tired of the rain!

Of course, we know it’s ultimately good for all the farmers and ranchers, but could we have a couple of clear days here or there? While dodging rain drops, make sure to take part in some upcoming continuing education opportunities for you and your staff in the coming weeks!

- Writing Teller Training and Procedures, May 6, webinar — This program will take a look at training for the teller. What needs to go into the training? What needs to stay out? Who should write the training and procedures and what is the purpose?

- The Top Ten Loan Documentation Mistakes and How to Avoid Them, May 7, webinar — When it comes to loan documentation, you must know the correct procedures and how to avoid frequent exceptions and mistakes.

- 10 Common Errors on Nonresident Alien Accounts, May 8, webinar — If you are asking your customer, “Are you a U.S. citizen?” at account opening, you might be asking the wrong question. A better question is, “Are you a U.S. person?”

- Overdraft Programs and Risks to Your Financial Institution, May 13, webinar — Overdraft services continue to be a target for regulatory scrutiny in 2025 and financial institutions who’ve been cited can attest to the damage unchecked fee income practices can have on an organization.

- Marketing Compliance: Avoiding Violations in Print & Digital Advertising, May 14, webinar — Whether your marketing promotions are digital, print or televised, multiple compliance regulations strictly prescribe what can be said, the elements that should be included and how they should be displayed.

- Vendor Management Program: How Model Risk Fits In, May 15, webinar — With financial institutions increasingly relying on third-party providers to offer their products and services, the associated risks also rise.

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!