In This Issue…

- From Adrian’s desk …

- OCC to combine community bank, large bank supervision departments

- Fraud trends report in auto lending released

- New enhancements live for ELT system

- ‘The Bankers From Oklahoma’ are back! – OBA convention registration open!

- OBA education corner …

From Adrian’s desk …

By Adrian Beverage

OBA President & CEO

Just some random tidbits that might be of interest to our bankers this week!

• • •

We celebrated my dad’s 80th birthday this past weekend. Thank you to everyone who contributed a note to us to share with him, it was a wonderful day!

• • •

We’re getting late in spring and we only have one session of each left for our Contact Banker Program and our Bankers’ Night Out events. Well, I guess that’s a bit misleading as we do have a special lunch edition of the Bankers’ Night Out programs set at Shangri-La on April 30. Then, later that evening, we wrap up this year’s edition of the events with our annual trip to Pete’s Place in Krebs!

As for Contact Banker, the last chance to join us during this legislative session is on April 29!

• • •

As I mentioned last week, we’re on to the diamond sports seasons in Nebraska. Well, there’s not much good to say about baseball: the ‘Huskers are floundering about under .500 at the moment. The softball team, however, is ranked in the top 25 and just hosted a program-record crowd this past weekend!

OCC to combine community bank, large bank supervision departments

The Office of the Comptroller of the Currency last week announced an organizational restructuring that will include combining its Midsize and Community Bank Supervision department with its Large Bank Supervision department.

The new Bank Supervision and Examination department will encompass activities currently performed by the two departments, according to an OCC statement.

“Blending the large, midsize and community bank supervision activities will allow for the seamless sharing of expertise and resources to address bank-specific issues or novel needs and provides opportunities for career development and progression for the agency’s entire examination workforce,” the statement said.

Greg Coleman, senior deputy comptroller for Large Bank Supervision, will lead the Bank Supervision and Examination office. Beverly Cole, the senior deputy comptroller for Midsize and Community Bank Supervision, will retire in May.

Fraud trends report in auto lending released

Sharon Lewis, with the OBA’s fraud division, has followed Frank McKenna (www.frankonfraud.com) for a long time. Frank is the chief innovation officer at Point Predictive, a lending confidence and risk management company.

Point Predictive just released their 2025 Auto Lending Fraud Trends Report. Click here to download the report. According to the report, did you know … the estimated fraud loss exposure for the auto lending industry exceeded $9.2 billion in 2024. Also, read in the report how the “South Beach Bust Out Syndicate” has submitted fraudulent loan applications valued at more then $10 million with vehicles being shipped to overseas markets; who the top 20 fake employers are o what the red flags are for early pay default.

New enhancements live for ELT system

Earlier this month, Service Oklahoma launched several upgrades to the Electronic Liens and Titles system – part of its continued effort to modernize vehicle services and improve the experience for lienholders, dealers, licensed operators and customers statewide.

Helpful Resources Available

To help you navigate these updates, Service Oklahoma has compiled several tools:

- FAQs — Answers to common questions attached.

- Training Guide — Step-by-step instructions for lien placement in OkCARS attached.

- Demo Video — A walkthrough of the latest features.

- Contact Us — Email eltaccounts@service.ok.gov.

If you’re not currently receiving ELT updates from Service Oklahoma and would like to be added to our distribution list, reach out to the team at eltaccounts@service.ok.gov.

As a reminder, here’s what’s new:

- Expanded Vehicle Info Access — Lienholders and dealers now have access to additional vehicle details in OkCARS, supporting faster, after-hours decision-making.

- Dealer Lien Placement — Dealers can now electronically add liens for any lienholder through their OkCARS accounts. This streamlines processing, reduces paperwork and enhances overall efficiency.

- Electronic Title Bill of Sale — A new notarized bill of sale is now required when transferring ownership of vehicles with electronic titles. The form is available on the Service Oklahoma website.

- Full Transition to Electronic Titles — Beginning July 1, all vehicle titles will be issued electronically, with limited exceptions. Paper titles issued prior to this date will remain valid until the next transaction, at which point they will be converted to electronic.

Live ELT Q&A – 3 p.m., May 21

Have questions about these changes? Save the date and join Service Oklahoma staff for a live Q&A session dedicated to lienholders at 3 p.m. on Tuesday, May 21.

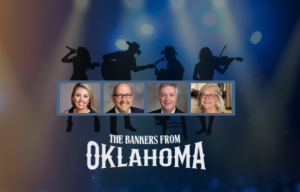

‘The Bankers From Oklahoma’ are back! – OBA convention registration open!

Join us in Oklahoma City this May for the can’t-miss event of the year – packed with valuable sessions, networking and a chance to reconnect with Oklahoma’s banking community. Whether you’re looking to expand your knowledge or simply enjoy a great time with fellow professionals, this event has something for every banker.

The connections are real, the conversations are waiting and your name tag is practically begging for a lanyard. We may not have fiddles or guitar solos, but we do have the ultimate gathering this side of Stillwater. Register now to secure your spot!

May 12-14, 2025

The Skirvin Hilton

1 Park Avenue

Oklahoma City, OK 73102

*Due to pricing structure online registration is not available.

OBA education corner …

Some of us were listening to Brooks & Dunn tunes this weekend when the duo’s massive 2001 hit, “Ain’t Nothing ’bout You” came on. While the song is one of the biggest hits in Brooks & Dunn’s career, spending six week as the No. 1 song, the lyrics are confounding.

There ain’t nothing ’bout you

That don’t do something for me

What the heck does that mean? Does nothing she does do anything for him? Or vice versa? Or is there is a vice versa? Do BOTH the non vice versa AND the vice versa literally fail to make sense?! While finally realizing why your high school English teacher took points away for double negatives, make sure to take part in some upcoming continuing education opportunities for you and your staff in the coming weeks!

- Security Awareness Training: Best Practices for Keeping your Employees Engaged, April 28, webinar — It’s time to shift our thinking when it comes to security awareness training. Yearly education and testing just doesn’t cut it in today’s cyber world.

- Advanced Commercial Lending Workshops, May 1-Advanced Cash Flow Analysis, May 2-Advanced Tax Analysis, Oklahoma City — The cash flow analysis seminar will explore multiple models of both business and personal (business owner) cash flow analyses. Meanwhile, the tax return analysis seminar will provide the banker with several advanced tax return concepts and related analyses to help them more effectively work with their business customers.

- Managing All Aspects of Debit Cards, May 1, webinar — This session is specifically designed to explain the regulatory compliance requirements for issuing, servicing and managing the institution’s debit card product along with internal control and fraud prevention tips.

- Writing Teller Training and Procedures, May 6, webinar — This program will take a look at training for the teller. What needs to go into the training? What needs to stay out? Who should write the training and procedures and what is the purpose?

- The Top Ten Loan Documentation Mistakes and How to Avoid Them, May 7, webinar — When it comes to loan documentation, you must know the correct procedures and how to avoid frequent exceptions and mistakes.

- 10 Common Errors on Nonresident Alien Accounts, May 8, webinar — If you are asking your customer, “Are you a U.S. citizen?” at account opening, you might be asking the wrong question. A better question is, “Are you a U.S. person?”

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!