In This Issue…

- FDIC releases 2019 results

- Review your bank’s information for OBA Directory

- Coronavirus guidance issued

- New employee benefits survey readied

- S.2563 faces uphill slog on BSA/AML issues

- OBA education corner …

FDIC releases 2019 results

This morning, the Federal Deposit Insurance Corporation released the year-end numbers for the banking industry. Here are the highlights:

- For 2019, net income declined 1.5 percent to $233.1 billion.

- Quarterly net income declined 6.9 percent from fourth quarter 2018.

- Net interest margin declined from a year ago to 3.28 percent.

- Community banks’ quarterly net income improved 4.4 percent from a year ago.

- Total loan and lease balances grew from the previous quarter and a year ago.

- The number of banks on the “problem bank list” remained low.

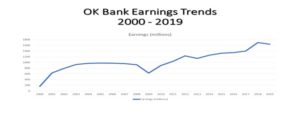

In Oklahoma, we’re now down to 198 FDIC-insured institutions. Net income for the banking industry in our state dropped slightly – t o $1.642 billion compared to $1.698 billion in the previous year (which was a record earnings year). Net interest margin (NIM) also dropped slightly – from 3.76% in 2018 to 3.64% in 2019.

o $1.642 billion compared to $1.698 billion in the previous year (which was a record earnings year). Net interest margin (NIM) also dropped slightly – from 3.76% in 2018 to 3.64% in 2019.

Return on assets dropped to 1.25% at the end of 2019, compared to 1.47% in 2018. Return on equity also dropped slightly to 11.68% compared to 14.16% the previous year. Four percent of Oklahoma banks were unprofitable last year compared to 3.48% in 2018. And finally, non-current loans are up compared to 2018 – 4.17% compared to 2.94%.

Click here to view the industry’s results for the past 3 years.

Review your bank’s information for OBA Directory

The Oklahoma Bankers Association Directory of Banks is again being produced this year by NFR Communications (formerly BankNews Media). To best serve you, we want to include the most up-to-date and accurate information about your bank, your branches and your staff. However, we need your help.

To ensure we are using the most accurate information, please follow the instructions provided in the letter that was mailed to your bank last week by NFR Communications. Please review and revise as necessary the financial directory listing for your holding company, your main bank and your branches. You can also use the login information that was included in the letter to update your listing online or, if needed, download a new form.

Completed forms may be returned by email to directories@nfrcom.com or faxed to 913-261-7010. Please update the information no later than the end of this week.

We appreciate your help in making the 2020 Edition of the Oklahoma Bankers Association Directory of Banks a success

Coronavirus guidance issued

The Centers for Disease Control and Prevention is responding to an outbreak of respiratory disease caused by a new coronavirus first detected in Wuhan City, Hubei Province, China. Unfortunately, the disease has now been detected in 37 locations internationally, including cases in the United States

The Coronavirus pandemic is forcing all businesses to be aware of this new health threat and what it means for their particular business interests. The CDC issued the guidance on Feb. 11, and will provide updates as needed and as additional information becomes available.

The interim guidance is based on what is currently known about the Coronavirus Disease 2019 (COVID-19). Much is unknown about how the COVID-19 spreads, and current knowledge is largely based on what is known about similar coronaviruses. It’s been published to help prevent workplace exposures to all acute respiratory illnesses, including nCoV, particularly in non-healthcare settings.

All employers are encouraged to use only this guidance to prevent stigma and discrimination in the workplace. Employers must make sure to maintain confidentiality of employees or customers with confirmed coronavirus infection, and avoid making determinations of risk based on race or country of origin. Click here to read the guidance:

Updates are available on CDC’s web page at www.cdc.gov/coronavirus/2019-nCoV.

New employee benefits survey readied

Blanchard Consulting Group and the OBA would like to invite you to participate in our 2020 Compensation Trends and Employee Benefits Survey.

The survey covers recent trends in various compensation programs such as: annual incentive plan design and payouts, equity/long-term incentive programs, executive benefits, including employment/change-in-control agreements, deferred compensation plans/supplemental executive retirement plans, perquisites and employee benefits surrounding 401K plans, tuition reimbursements, medical coverage and more.

This survey will provide valuable market data on a wide variety of compensation related topics.

Below is the pricing for the 2020 Compensation Trends and Employee Benefits Survey results (results will be provided via email in PDF format):

- OBA Member Participants: $150

- OBA Member Non-participants: $300

To complete the survey, please click here. The deadline to submit has been extended to Friday, March 6.

If you would like to pre-order your copy of the survey, or if you have any survey questions, please contact Laura Roth at surveys@blanchardc.com or 612-886-1225.

S. 2563 faces uphill slog on BSA/AML issues

Senate Republicans are marshaling forces to slow down or block action on S. 2563, which deals with modernizing current Bank Secrecy Act and Anti-Money Laundering rules. One of its key features is to transition from commercial banks to the Financial Crimes Enforcement Network (FinCEN) the responsibility to develop and maintain a national data base on the direct and indirect ownership of businesses across the nation.

“There are currently negotiations going on at some level,” said OBA President and CEO Roger Beverage. “Unfortunately, they’re being conducted in private, without sharing the progress with members of the Senate Banking Committee. It’s possible that a mark-up will take place in mid-March, but nothing has been scheduled yet.”

OBA education corner …

Are we on the downhill run to spring? Wait … I just read something about snow tonight? Oklahoma weather is so predictable in its unpredictability. While you ponder the meaning of the previous sentence, take a second to look over the events coming down the pike via the OBA’s education department:

- 2020 Call Report Seminar, March 10, Oklahoma City — This seminar will provide updates and training for experienced preparers and reviewers and will include complete coverage of new and complex issues impacting the Call Report preparation. New, proposed and revised changes will be presented in summary form at the beginning of the seminar followed by a more detailed discussion over the course of the seminar.

- Responsibilities of the Information Security Officer, March 10, webinar — Being the Information Security Officer for a financial institution is a big responsibility in today’s world of cyber threats and data breaches. This webinar is for those who are new to the role or have been the ISO for some time but want to review what is expected and how to be successful.

- ACH Origination and Same Day Entries, March 11, webinar — Are you new to the operations area of the bank? Is ACH Origination a new product for you? Is it something you’re afraid of? Then this class is for you! We will discuss the benefits of ACH Origination for your bank and your customers. Who makes a good originator and then we’ll dive into Article II of the ACH Rules.

- New Rules Regarding IRA Beneficiary Payouts, March 12, webinar — Learn more about the old and new rules for IRA nonspouse beneficiary payouts.

- Regulation E, March 13, webinar — As consumers continue their shift to a nearly all-digital platform for conducting personal financial transactions, a thorough understanding of Regulation E and the Electronic Fund Transfers Act is an absolute necessity for financial institutions.

- What To Do When A Customer Dies, March 17, webinar — We’ll walk you through the best practices when dealing with a customer’s death – both on the deposit side and the loan side, as well as unique issues that can arise when doing business with the decedent’s estate.

- Legal Liabilities When Check Fraud Occurs, March 18, webinar — Check fraud losses are estimated to exceed $18 billion each year. A recent nationwide counterfeit check operation is projected to have caused over $9 million in losses. With more and more counterfeit checks flooding financial institutions, this number is sure to increase.

- 2020 Bank Directors Training Seminars, April 1-Tulsa; April 2-Oklahoma City —Informed and engaged bank directors are key for a community bank’s success. These sessions broach on compensation, evaluations, and strategic planning along with other timely issues facing bank managers and their boards. The workshop is designed to assist bank directors and executive management with carrying out their duties and responsibilities.

Also, the OBA is proud to promote the recognition of bankers who have devoted 50 or more years of service to the banking industry. All eligible nominees will be honored at the 2020 OBA Convention on May 18-20 at the DoubleTree Warren Place in Tulsa.

Click here to download a nomination form. If you have any questions, please contact Janis Reeser at 405-424-5252 or janis@oba.com.

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!