In This Issue…

• Sandy’s salutations

• Oklahoma banking industry continues record pace

• FDIC releases decision on simplified capital requirements

• Could your bank take brief survey on armed guards/bank entrances?

• Oklahoma Bankers Hall of Fame ceremony set for Dec. 4

• OBA education corner …

Sandy’s salutations

By Sandy Werner

OBA Chairperson

Growing up, my dad always said, “Enjoy every day, because the older you get, the faster those days pass.”

Well, I must be ANCIENT because this year has flown by. We are fast approaching the holiday season, starting with Thanksgiving on Thursday. One of our traditions, which is probably shared by many, is taking the time to say for what we are thankful. So let me take a moment to share what I am thankful for, regarding OBA endeavors.

I am thankful for:

- The passage of S. 2155.

- Bankers submitting comments for CRA reform.

- Bankers responding to the Federal Reserve regarding its participation in real-time interbank settlements.

- Bankers continuing the fight to level the credit union playing field and point out the issues with CECL.

- Bankers learning about banking medical marijuana.

- Bankers advocating in Washington, D.C.

- Bankers serving on the OBA’s various boards, numerous committees, attending educational opportunities and taking leadership roles when asked.

- The OBA staff.

I could go on and on, but Jeremy only allows me so much space! So, to sum it all up, I am thankful for each and every one of you and for the opportunity to serve.

Wishing you and yours a blessed holiday season.

Together, we are the OBA!

——— Sandy

Oklahoma banking industry continues record pace

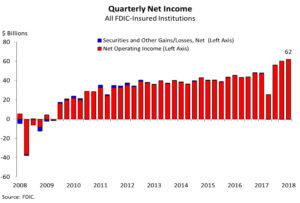

Today, the FDIC released its third quarter report showing FDIC-insured institutions reported aggregate net income in the amount of $62 billion, up $14 billion, or 29.3 percent, over last year at this point in the year. According to the agency, this increase in earnings came as a result of higher net operating revenue plus a lower effective tax rate.

According to the FDIC press release, 5,477 institutions insured by the agency – more than 70 percent – reported year-over-year growth in quarterly earnings. The percent of unprofitable banks in the third quarter declined to 3.5 percent from 4 percent a year ago.

“Oklahoma banks continued their upward performance and are well on the way to setting yet another earnings record,” OBA President and CEO Roger Beverage said. “It’s great to see this industry continuing on its path of helping Oklahomans and generating increasing reven

ue. That means the economy in Oklahoma is strong and should help more and more Oklahomans either continue to or enable them to prosper.

At right is the chart from the FDIC showing the graph of quarterly net income.

The FDIC also reported that the nation’s 5,044 insured community banks reported net income of $6.8 billion, which is up 21.6 percent over last year at this same time.

“This increase and upward earnings trend has come about in part as a result of the tax cuts by the Trump administration earlier in the year,” Beverage said. “It’s not the sole reason for the increase; bankers have worked hard to generate good loans and it’s showing up at the end of each quarter. Net operating income is up 7.6 percent and loan loss reserves have declined by 15.2 percent. That’s real

ly good news, on both fronts.”

The graph at right shows the progress banks have made since the year 2000.

“This upward movement looks good,” Beverage said. “I’ll be anxious to see the fourth quarter results in February and see the extent to which this trend continues. I have no reason to believe that it won’t.”

The American Bankers Association’s chief economist, Jim Chessen, issued the following statement on behalf that association:

The industry demonstrated another solid and consistent performance in the third quarter. Lending rose in every major category, helping to spur strong economic growth throughout the country. A strong job market and a healthy business environment have sparked intense interest in borrowing among consumers as well as businesses seeking to expand. Asset quality was the strongest it’s been in more than a decade while bank capital levels hit record highs. We’re also seeing competition for deposits heating up as banks look to further expand the lending that drives our economy forward.

“Bank capital now totals just shy of $2 trillion, further positioning banks to support continued loan growth. With capital ratios at record highs, the overwhelming majority of America’s banks – 99.6 percent – are well-capitalized, far exceeding the highest regulatory standards.

“In the 10th year of the economic cycle, problem loans continued to decline as increased reserves, stronger asset quality and higher capital safeguard banks against fluctuations. Banks are always sensitive to credit and interest rate risk, and maintaining judicious underwriting standards remains a top priority. Institutions are carefully monitoring the likelihood of any potential Fed interest rate increases in the months ahead, and they are well prepared to manage the current rate outlook.

“The FDIC’s deposit insurance fund has completed its recapitalization to higher levels set by Congress two years earlier than expected. The banking industry fully funds the FDIC’s operations and its insurance fund, which it has built up to more than $100 billion. A strong banking industry, healthy deposit insurance fund and tailored regulations are the right combination to maintain safety and soundness and support the longest economic expansion in history.”

FDIC releases decision on simplified capital requirements

The FDIC today announced its long-awaited decision on more simplified capital requirements for community banks under the provisions of S. 2155 passed earlier this year, in an effort to mitigate some of the over-reach brought about by Dodd-Frank.

“As I understand it, the leverage ratio for just about every bank in Oklahoma (under $10 billion in total assets) is at 9 percent of tangible equity to total assets,” OBA President and CEO Beverage said. “Obviously that’s smack dab in the middle of the published range contained in the bill. But the main point is it enables community banks to avoid having to operate and deal with the much more complicated requirements of Basel III, which never made sense and were never intended to apply to smaller traditional banks.”

The FDIC reported it estimates more than 80 percent of the nation’s community banks would be qualified for this simpler leverage minimum.

Click here to read the article in today’s American Banker newspaper:

ABA President Rob Nichols reacted to the new leverage ratio established:

“We believe there is room for regulators to go further,” he said. “Strong capital requirements don’t need to be complex to calculate, which is why Congress wanted healthy community banks to spend less time filling out paperwork documenting their capital positions and more time serving local communities and small businesses. If designed as Congress intended, the community bank leverage ratio will be an optional and viable alternative to risk-based capital rules that have long been a poor fit for community banks.

“Unfortunately, the 9 percent leverage ratio proposed by regulators will still leave too many well-capitalized community banks forced to follow capital rules always intended for more complex institutions. We appreciate regulators putting the proposal forward, and we look forward to working with them to improve it.”

Could your bank take brief survey on armed guards/bank entrances?

We’re wanting to get information on banks’ usage of armed guards and the number of entrances at each bank branch. If your bank hasn’t already, could each bank CEO could fill out this VERY brief survey (three total questions) for each of their locations based in an area with less than 100,000 in total population, we’d appreciate it.

Please, only one response per bank location, please!

https://www.surveymonkey.com/r/JKWKYXY

Oklahoma Bankers Hall of Fame ceremony set for Dec. 4

The Oklahoma Bankers Hall of Fame will induct its first-ever class on Dec. 4 at the Oklahoma History Center in Oklahoma City. Shawnee banker Larry Briggs, Altus banker Ken Fergeson and Oklahoma City banker Gene Rainbolt will make up the inaugural class.

If you are interested in attending the event, please RSVP to the OBA’s Nancy McKinnis at (405) 424-5252 or nancy@oba.com. The cost for an individual seat is $65 and $500 for a table of eight.

The ceremony will take place from 11:30 a.m. to 1 p.m. at the Oklahoma History Center, which is located at 800 Nazih Zuhdi Dr., in Oklahoma City.

OBA education corner …

Can anyone believe the holidays start this week?! These past few months have just FLOWN by! With that in mind, don’t let continuing education opportunity through the OBA fly by you and your fellow bankers! Take note of the following:

- Developing and Documenting a CRA Assessment Area, Dec. 4, webinar — This program focuses on the proper method of delineating an assessment area.

- Basic Bankruptcy for Bankers, Dec. 4, webinar — This webinar will introduce you to the world of bankruptcy. It is designed for lenders and support staff with the goal of educating them on the fundamentals of both consumer and commercial bankruptcy law.

- IRS Information Reporting Rules Forms, Dec. 5, webinar — Learn about the many forms financial institutions must report, with an emphasis on when and exactly what to report.

- Loan Documentation 101: Two Part Series, Dec. 5 & Dec. 6, webinar — Learn about specific classifications of collateral and language description requirements for UCC-1s and security agreements.

- The Five Pillars of BSA, Dec. 6, webinar — This webinar is designed for BSA officers, BSA coordinators, compliance officers and security officers.

- Excel 101: Introduction to Spreadsheets, Dec. 7, webinar — If you’ve never worked with Excel spreadsheets or haven’t in several years, this webcast is designed just for you.

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!